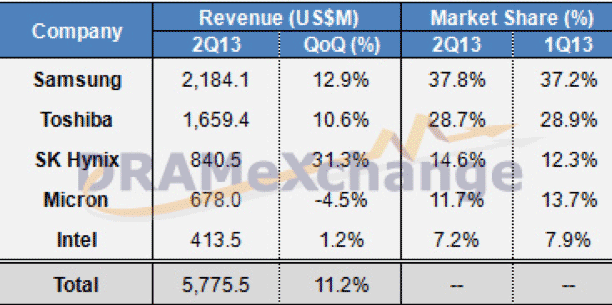

Record NAND Flash Revenue in Q2 2013

Referencing the latest report by TrendForce, Samsung continues to lead all suppliers in the production of NAND flash again in Q2 2013 with 37.8% worldwide market share. Toshiba follows in second with 28.7% with Hynix, Micron and Intel well below at 14.6%, 11.7% and 7.2% respectively.

Overall NAND revenue for Q2 2013 reached a new record of almost $5.8 Billion, due to steadily increasing contract prices and a widening use of SSDs in place of HDDs and managed NAND solutions in Commercial and Consumer applications.

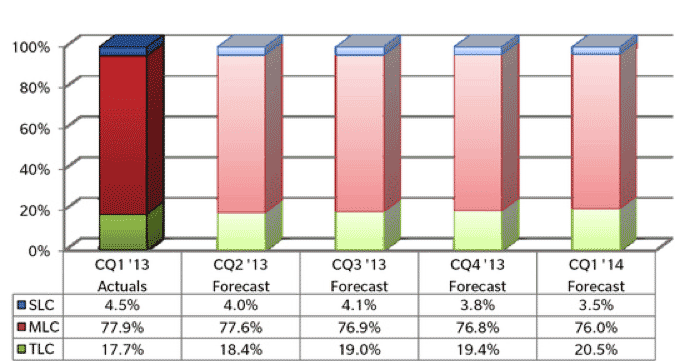

The latest actual data from Trendfocus shows MLC NAND being the majority of production at >75% of the market followed by TLC NAND at 18% and SLC at 4.5%. The driver of the MLC NAND flash is the Enterprise SSD, mobile and tablet market while the TLC NAND tends to be used mainly in Consumer flash card products. SLC NAND is used almost exclusively in the Industrial, Networking and some Enterprise SSD applications.

I once heard a wise man say, "The lowest cost memory technology will drive technological innovation." That's exactly what is happening with the NAND memory market today. The lowest cost TLC NAND is creating the need for innovations in controller technology to mitigate its deficiencies in reliability.

TLC and MLC NAND usage begins in the lower reliability applications of consumer flash cards and as controller technology improves, this lower reliability NAND begins to be used in higher reliability applications. At the end of the day, there is no substitute for the highest reliability SLC NAND in Industrial and Networking applications where a flipped bit is unacceptable.